iowa inheritance tax rate

In 2020 federal estate tax generally. Grow Your Legal Practice.

How Much Is Inheritance Tax Community Tax

A bigger difference between the two states is how the exemptions to the tax.

. These tax rates are based upon the relationship of. That is worse than Iowas top inheritance tax rate of 15. It has an inheritance tax with a top tax rate of 18.

Learn About Sales. In 2013 the Indiana legislature repealed their inheritance tax completely. There are Tax Rate C beneficiaries which applies to uncles aunts nieces nephews foster children cousins brothers-in-law sisters-in-law and all other individuals.

If the net value of the. File a W-2 or 1099. Iowa collects inheritance tax for inherited property but tax rates depend on the degree of relationship of the beneficiary and the decedent.

LegalMatch can tell you how you. These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie. 25001-75500 has an Iowa inheritance tax rate of 7.

Up to 25 cash back Spouses children and parents of a deceased person are exempt from Iowa inheritance tax while other inheritors might have to pay. Adopted and Filed Rules. That is worse than Iowas top inheritance tax rate of 15.

If instead you are a sibling or other non-linear ancestor then you are subject to. Learn About Property Tax. Report Fraud.

The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Inheritance Tax Rates Schedule.

What is Iowa inheritance tax. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Six states collect a state inheritance tax as of.

If your relation to the person leaving you money is any of the above you wont owe inheritance tax regardless of the size of your inheritance. 2022 taxiowagov 60-064 05312022. 12501-25000 has an Iowa inheritance tax rate of 6.

States levy an inheritance tax. Iowa is planning to completely. The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed.

On May 19th 2021 the Iowa Legislature similarly passed SF. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. Only six US.

619 a law which will phase out inheritance taxes at a. A summary of the different categories is as follows. For more information on the limitations of the inheritance tax clearance see.

Iowa Inheritance Tax Rates. 0-12500 has an Iowa inheritance tax rate of 5. For decedents dying on or after January 1 202 but before January 1 2022 the 3applicable tax rates listed in Iowa.

The estate tax is a tax on a persons assets after death. What is the inheritance tax 2020. Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary.

For more information on exempt beneficiaries check out Iowa Inheritance Tax Law Explained.

.png)

Iowa Inheritance Tax Law Explained

Recent Changes To Iowa Estate Tax 2022

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

How To Calculate Inheritance Tax 12 Steps With Pictures

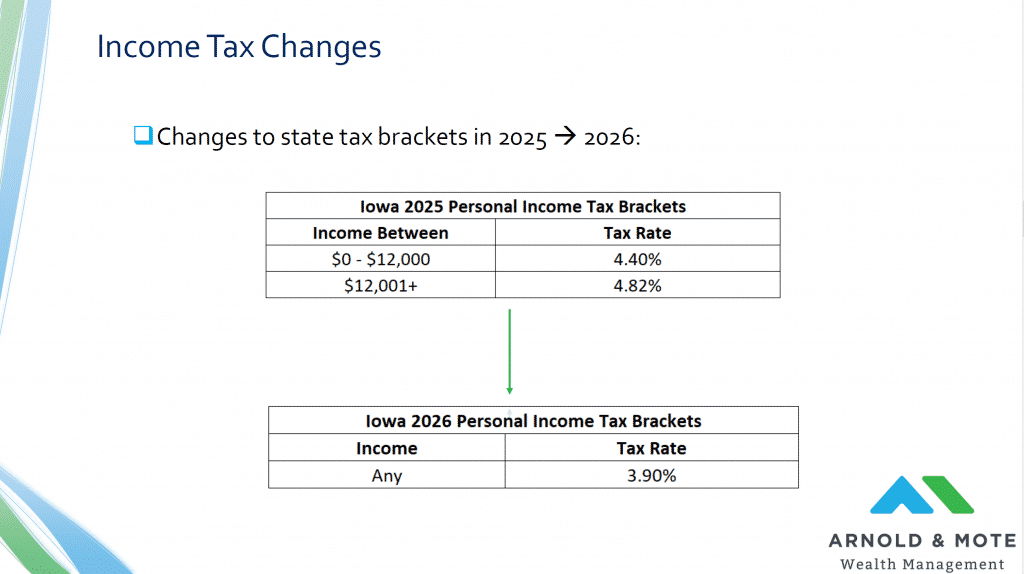

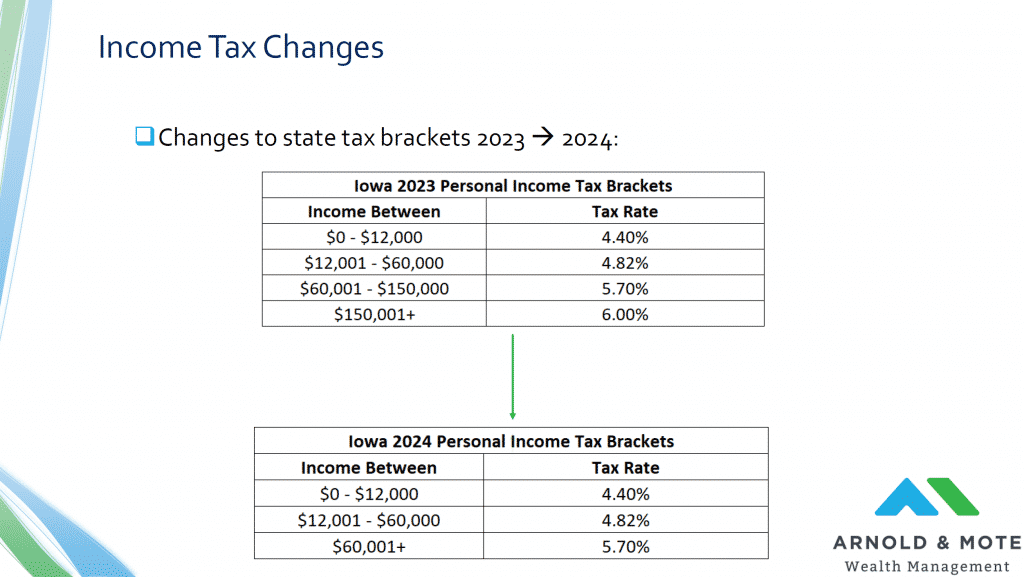

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation

Tax Talk If You Die In Iowa Is There A State Estate Tax Gordon Fischer Law Firm

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Iowa Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes In 2014 Tax Foundation

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How Much Is Inheritance Tax Community Tax

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Estate Tax In The United States Wikipedia

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation